The pool of financial services offered to customers and engaged by the common public in today’s digital world demands a sophisticated system to collect, connect and collaborate data seamlessly. This is a reason that banking organizations are stepping up to uplevel their automation game and offer the service as per the customer’s needs and preferences.

Although RPA tools are often integrated with multiple banking and insurance processes like claims processing, account opening, reconciliation, and KYC process. But with the changing technology landscape, it has discovered new cognitive abilities integrated with major AI technologies like Machine Learning, Natural Language Processing, and OCR.

By combining these automation technologies, both structured and unstructured data processing can be automated without the need for data analysts and other certified FTEs.

As a result, banking organizations, and other financial institutions have also adopted this new-age RPA in banking industry for trade monitoring – instead of creating financial macros from multiple service lines.

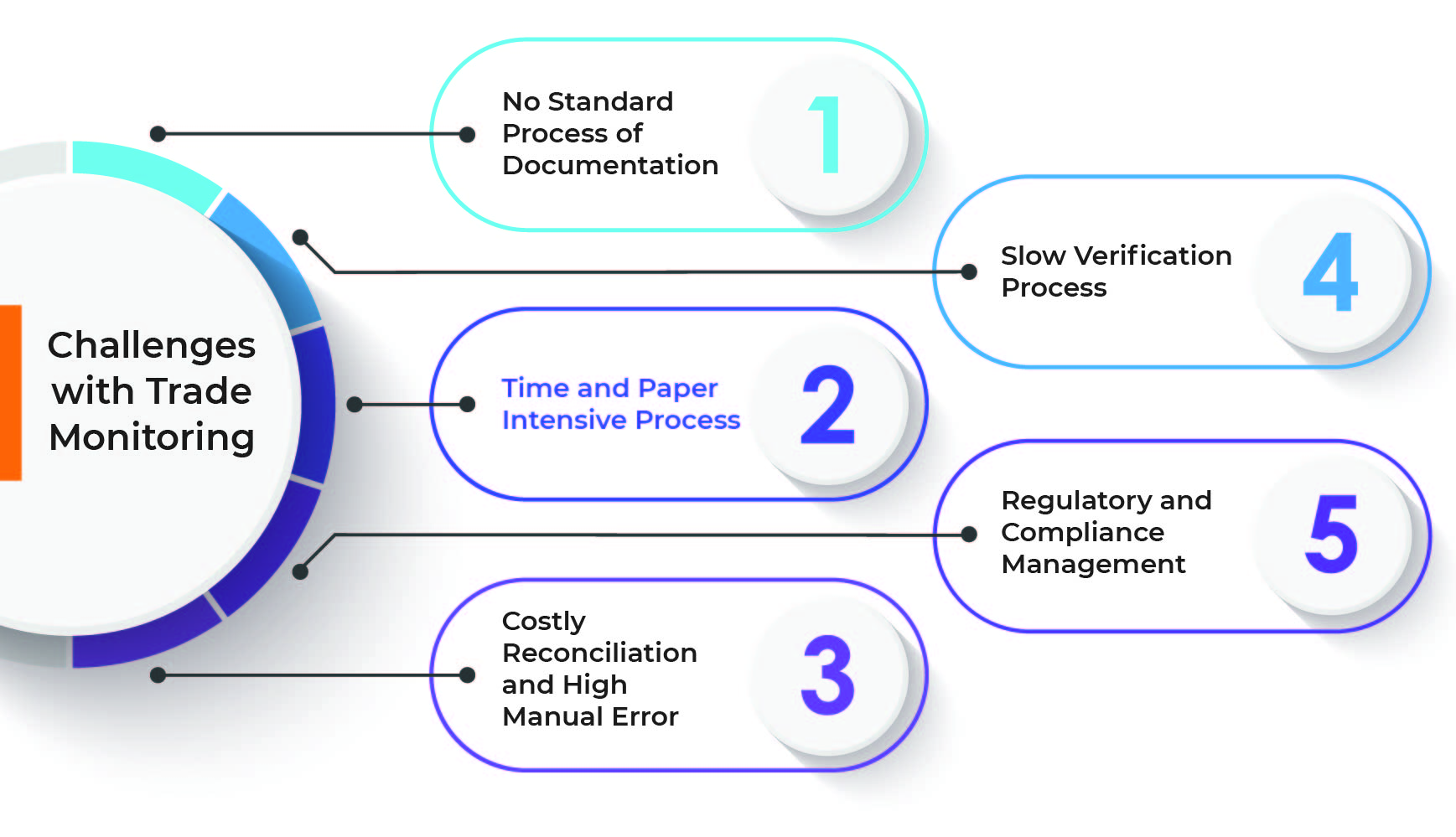

But, is trade monitoring as easy as it looks? The answer is no. let’s discuss more in this blog about the importance of trade monitoring and how by using RPA in fraud detection we can enhance trade monitoring.

What is Trade Monitoring for Banking Industry?

Trade monitoring is the means by which a bank monitors its customers’ financial activity for signs of money laundering, terrorism financing, and other financial crimes. The trade monitoring process enables banks to understand their customer and the business in which they are investing.

Trade monitoring also helps the banking industry to reveal important details about the transactions themselves like how much money is involved, where it is shared, and what is the source of money.

Moreover, trade monitoring is a complex business process and if processed manually it should not pose any risk of money theft. But, with a large volume of data tracking requires more time and manual effort for detecting fraud. The banking employees have to capture the following data for trade monitoring-

- Transactions involving customer money

- Frequency of transactions by customers

- Details of senders and recipients involved in transactions

- Destination involved in a processing transaction

- Studying the relationship between a transaction and the expected financial behavior of a customer

Discrepancies in data management can be fatal to customers and can also add financial risk to the banking industry. As per the e-commerce fraudulent report, 17.46% of all global e-commerce transactions between Thanksgiving and Cyber Monday were potentially fraudulent. Hence, monitoring these discrepancies requires constant monitoring all across the organization to detect any fraud and money laundering. And to erase these pain points and improve trade surveillance, RPA and AI technologies can be game changers.

How RPA in Fraud Detection can Improve Trade Monitoring?

RPA is a business process tool that can automate the repetitive process by mimicking human activity and also can be designed with a predefined workflow for better task management. In the fraud detection process, RPA can be used for many reasons, some of them are-

- Reduction in Human Capital

- Increment in Revenue per employee

- Operational Cost Reduction

- Real-time monitoring

- No clerical errors and a faster process

Moreover, when combined with cognitive technologies RPA can transform fraud detection in a superficial way. It brings the manual effort to the minimum as AI bots can handle the process flawlessly and keep humans in the loop in case of decision-making if required. That’s the power of RPA. Here’s how RPA helps the banking industry mitigate fraud risk and offer better trade monitoring-

- Reassess Current Process

RPA bots work in a consistent manner and review every former and current financial transaction happening across the banking organization. And the best part about RPA is to identify uneven patterns during the transaction flow and catch cases of fraudulent activities and piracy. Also, using AI in combination with RPA helps banking organizations to get real-time data monitoring as this pattern might get missed during human inspection of transactions. - Track Fraud Detection Faster

Irrespective of organization, tracking and monitoring any activity requires smooth data extraction and processing. And banking employees struggle to collect data from multiple sources due to the high volume of data stored in the banking database. Also, this data comes unstructured, analysing it and converting it requires more time from employees. But, RPA in fraud detection can erase all these challenges and track fraud autonomously. By evaluating each transaction for potential fraud, the RPA bot flags high-value transactions in perilous sectors. A major advantage of these tools is that they raise a red alert whenever high-value transactions take place and investigate any disparity before the crime is committed. That’s how RPA in banking can bring more transparency to all transactions. - Maintain Record Autonomously

Financial services and banks are audited annually as a standard practice. Several eyebrows are raised when proper documents are not provided for each settlement. In addition to the bank’s reputation, the employees associated with it can also come under scrutiny. Banking employees have to collect data right from transactions happening between two parties, transaction frequencies, to points of transactions occurring all across the organization. With RPA banks can easily collect data using intelligent document processing solutions from multiple sources, store them in a centralized database and share it with customers and employees as per their requirements in real-time. RPA in financial automation not only reduces the manual dependency on the process but also enables banking employees to focus on the decision-making process. - Remove Temporary Block Accounts

Banks have to deal with thousands of customer accounts and quite often, a majority of them remain sedentary for months on end. Whenever banks notice suspicious activity with these accounts, they temporarily block them. While temporary blocks age out, the blocks remain and must be manually unlocked by a bank professional. Unblocking these accounts might take days and months to process. But, RPA bots can effectively identify accounts with such blocks, access past activity, and remove all the blocks without using human efforts. Removing these block accounts helps in better audit report management and maintaining regulatory compliance.

[Also Read:What is RPA in Banking and Finance ? Use Cases, Benefits, and Challenges in 2023]

Is RPA in Fraud Detection Best Solution for Improving Trade Monitoring?

The answer to this question can’t be described in plain “YES” or “No”. Because RPA has crossed all the classifications when it comes to monitoring fraud for trade surveillance. RPA might have started as a basic technology to automate a repetitive and manual process, but with a combination of AI technologies, it is becoming the strongest option for fraud detection and a much more complex process that requires decision-making. Using RPA not only helps banking and financial organizations not only maintain their competitive edge but also in enhancing process efficiency and better customer experience. So. don’t let the repetitive process deter the banking process and let the automation make noise in fraud detection for better trade monitoring.