Introduction

Automation has been a critical driver in the insurance industry in recent years. Changing customer preferences, digitization and better risk management have elevated the need for insurance workflow automation. Insurance organizations deal with multiple workflows for insurance processes, such as claims underwriting and policy issuance.

Customers require instant responses from the insurance team regarding their policies, new product services and claims settlement. A recent report by Accenture stated that around 50% of insurance customers prefer using digital channels when looking for product information. In that scenario, paper-heavy operations and legacy systems need a revamp to fast-track customer resolution and better utilization of resources. Insurance workflow automation can replace manual and repetitive tasks with automated solutions, and benefit insurers by responding instantly to customers. According to McKinsey, insurers can reduce operational expenses by 40% using workflow automation.

Look at this blog and learn about insurance workflow automation and workflow automation use cases for the insurance industry.

What is Insurance Workflow Automation?

Insurance workflow automation software allows insurers to organize and create workflows using RPA, AI, and Intelligent Document Processing automation technologies. These workflows can be configured to include a variety of tasks, such as data entry approvals and alert generation. They can also be set up to be triggered when a previous task is completed.

For example, when a customer submits a claim request, workflow automation automatically triggers a series of tasks like claims assessment, verification, and approval. The next task starts as soon as the first task is completed, resulting in faster execution.

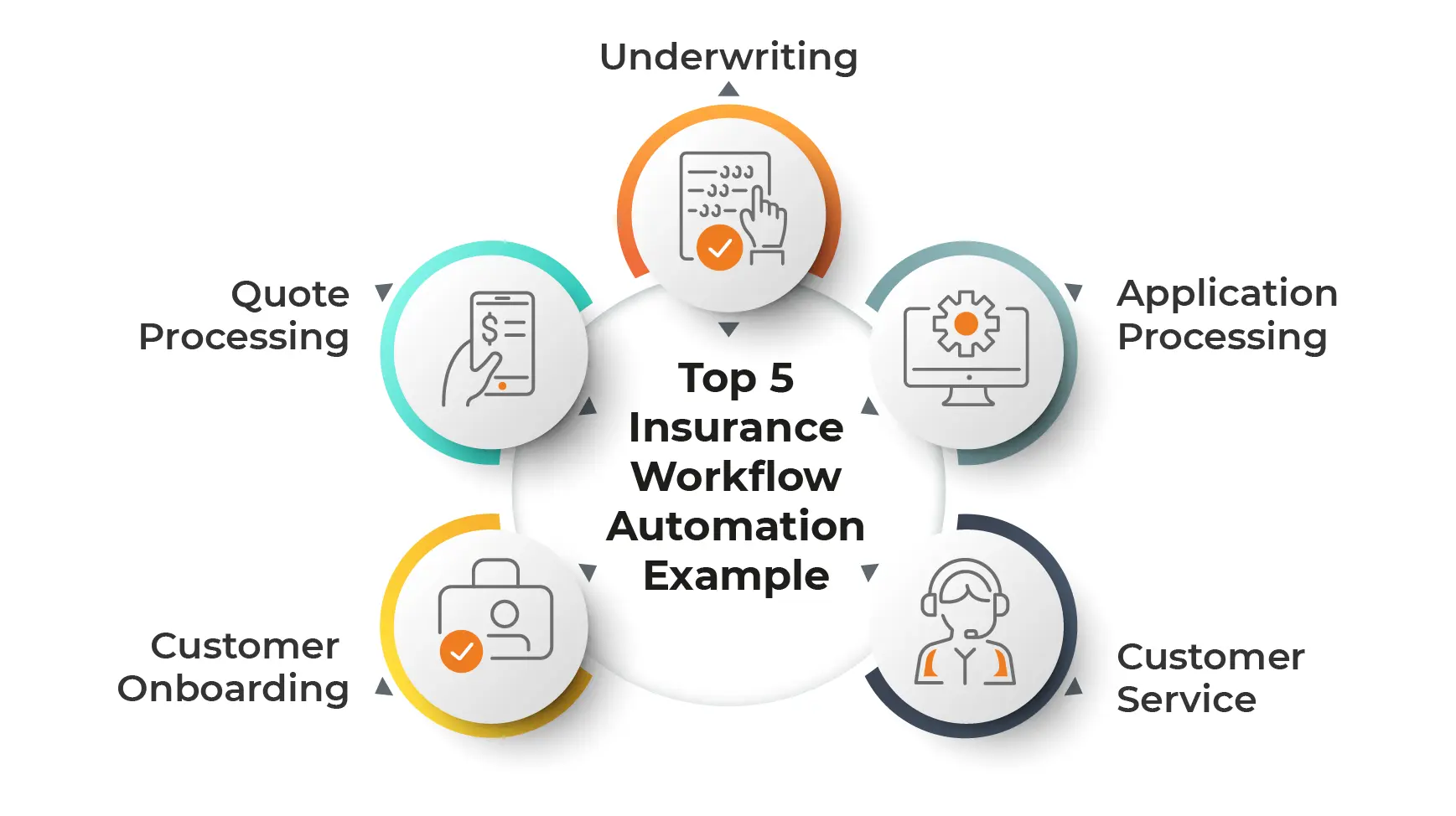

Insurance Workflows Automation Examples

As per reports, the workflow automation market is expected to reach USD 34.18 billion by 2024. Some examples of insurance workflow automation are:

-

Application Processing

Insurer receives various applications like claims, policy issuance and quote generation that needs from customer for quick resolution. . Manually receiving applications, reviewing them, and determining the coverage and pricing is challenging. Workflow automation tools can automate multiple tasks in application processing.

Suppose when insurers receive policy issuance requests, insurance organizations can create a workflow automation system that includes tasks like application review, verification of applicant information, compliance checks, and renewal notices. Once the system is triggered, the workflow automation tool starts performing tasks from application review to sending the renewal notices.

-

Customer Service

Customer service in insurance is one of the most challenging parts for any organization, which is why insurance process automation has become much more critical with changing customer preferences. Workflow Automation in insurance customer service can handle workflows like answering customer questions, resolving customer complaints, and updating policy information, as well as collecting compliance information.

For example- If a regulatory authority mandates additional information for insurance coverage, an organization may need to reach out to hundreds of thousands of customers to update their profiles. Using workflow automation software, a unique link can be generated via triggers in the CRM system. After the customer completes the information, it is automatically reintegrated into the CRM, eliminating the need for human intervention.

-

Underwriting

Insurers receive high-volume data, including customer information, claims details, policy details and financial records for assessing risk. Workflow automation tool here can create a seamless data flow by handling tasks like data collection, verification and processing for execution.

Underwriters have to assess the risk each applicant or entity brings with them. To assess the risk, insurers must fetch data from multiple touch points and iterate information like applicant details, credit history, etc. Insurers can automate this process by creating automated workflows for data intake, risk assessment, real-time claims tracking and tracking changing regulatory norms. This helps speed up the underwriting process and increases the response time to customers.

-

Quote Processing

To process a quote for an insurance plan, insurers need to take care of multiple workflows. It gets more challenging when customers want instant access. Automating workflows like requests for proposals, data extraction, pricing calculation, quote preparation, review and approval, and post-sale follow-up.

Workflow automation begins when a customer submits a quote request. Automated insurance workflow instantly gathers customer details and requirements, integrates data into the system, calculates pricing based on rules, and generates quotes. Once the quote is generated, it also follows up with the customer and logs the interaction into the system.

-

Customer Onboarding

Communication is one of the roadblocks that insurers face during customer onboarding. Manual processes and old legacy systems can result in delays, errors, and a fragmented customer experience. Insurers can reduce administrative overhead by integrating workflow automation solutions into their systems and creating automated follow-ups and customer communication. Through automated reminders and personalized messages, insurers can update customers on claims, policies, renewals, and many other touchpoints.

Conclusion

In summary, insurance providers looking to elevate their working experience must look for insurance workflow automation to speed up the process. Workflow automation is a transformative solution that empowers insurance providers to fast-track their processes, reduce administrative overhead, maintain operational expenses, and deliver superior customer experience.

Learn more about how AutomationEdge workflow automation solutions can benefit your insurance company.