The fintech industry has seen a drastic change in its service operations due to less employee productivity, increased online fraud, and enhanced risk assessments. And with rising competition in the market, the BFSI industry no longer wants to limit abilities to traditional automation.

Hence, the necessity to adopt conversational technology and AI-powered chatbots to boost efficiency and productivity is on the rise. As per market research, global conversational AI is expected to account for USD 46.29 billion in 2019.

However, the boom of AI chatbots has taken care of the major issues, but not all have understood the role of conversational AI in the fintech industry.

In this blog, we will look at the way conversational AI is making a change in the Fintech industry.

What is Conversational AI?

Conversational AI is any software through which a person can talk to. It could be a chatbot, social messaging app, virtual assistant, or any other interactive voice-enabled interface. It is not a substitute for human-to-human interaction, instead, it is a substitute for situations where employees are entrapped with repetitive and time-consuming tasks.

What’s more compelling about conversational AI is that it uses Natural Language Processing and Machine Learning technologies that provide a more realistic experience than traditional chatbots. With predictive analytics, conversational AI offers both text and voice modalities with multichannel support.

As per business insider intelligence, “conversational AI in banking operations can save up to $416 billion.” That’s one of the reasons digital banking is one of the most strengthened by AI & automation.

Overall, conversational AI offers a whole new category of capabilities that financial leaders can leverage to serve their customers and stakeholders.

Types of Conversational AI for the Fintech Industry

1. Rule-Based Chatbot

As the name suggests, rule-based chatbots are automated programs that work on a predefined set of rules. These chatbots mainly function as an “information acquisition interface”.

Like a flowchart, these rule-based chatbots map out conversations and respond to customer queries like FAQs, payment schedules, transaction alerts, and then it searches for information and responds accurately. As per Gartner, by 2022 chatbots will be handling 88% of customer service interactions.

By mimicking human actions, rule-based chatbots provide 24/7 availability and instant response to the customer. Also, with rule-based chatbots, you can better control the behavior and response of chatbots.

2. AI-based Virtual Assistant

Unlike rule-based chatbots, virtual assistants use AI-enabled technologies like NLP and machine learning to understand the intent of customer queries.

With predictive analytics and the decision-making process, AI-based virtual assistants learn from previous experience and provide resolution without manual intervention.

Also, these chatbots can perform specific tasks for customers like resetting passwords, card renewal, transactions, account registration, deposits, and others. With quick resolution and enhanced support outcomes, virtual assistants enable fintech agents to save operational costs and make smarter decisions.

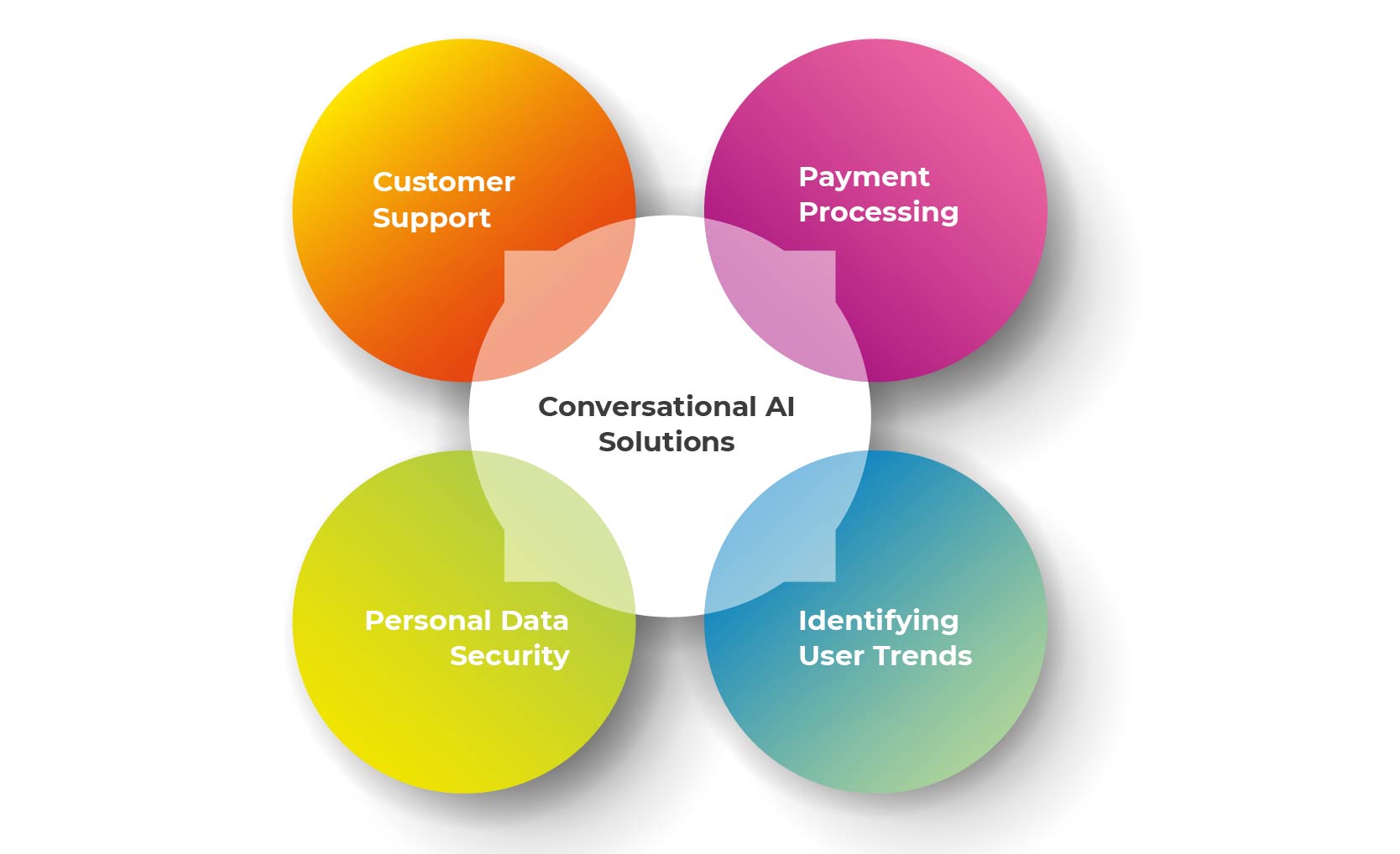

Conversational AI solutions for the Fintech

- Customer Support

A robust customer support structure is imperative to scale and become a market leader. Customers in the fintech industry look for instant resolution in queries such as account balance summary, transaction alerts, generating pin, credit/debit card renewal assistance, and more.

And with high volume customer queries, the service desk agent shuffles from one system to others for resolution. This constant struggle along with delaying resolution leads to unresponsiveness.

But with conversational AI, customer queries can be resolved quickly. As the first line of customer interaction bots can engage quickly with customers, evaluate their queries, extract the information and provide the resolution without manual intervention. With personalized service across all channels, chatbots offer an integrated service and reduce customer friction points.

- Payment Processing

Assisting customers with peer-to-peer transactions requires constant monitoring. Also, obsolete payment solutions take several days rather than seconds for successful transactions. And processing safe payment manually comes with time constraints and deters employee productivity.

An AI-powered virtual assistant can ease payment processing by integrating customers’ payment mode with the bot and enabling them to pay bills online, money transfer, check account balance, and others.

Besides, these virtual assistants don’t require separate infrastructure, it can be easily integrated with the existing legacy systems. By providing an end-to-end payment process, customers can easily manage their finance in one place with ease.

- Identifying User Trends

Obtaining quality information in real-time requires constant labor and manual effort. And fintech organizations need to position themselves in a manner that resonates with their consumers.

Also, to create new services and products, organizations must know the customer behavior and pattern. In addition, creating a lead generation, educating users regarding their customers, and engaging customers to buy financial products like credit cards, home loans, personal loans, and solutions are quite challenging for the marketing team.

With predictive analytics, machine learning, and AI-enabled bots, organizations can instantly obtain interactions and know customer needs in a better way, and improve their experience. Also, Artificial Intelligence(AI) helps in fraud management to gain insight into client behavior and grasp what’s ordinary or not, to save the business from losses.

- Personal Data Security and Protection

In fintech and digital banking, without a robust security measure, your sensitive data may be at risk. Many fintech organizations use third-party services from their vendors to serve their customers.

Hence, the rate of cyber threats and unencrypted data might lead to issues like fraud, data stolen, spoofing, and others. Furthermore, it’s essential for organizations to make payments, transactions, and fund transfers safer to keep their customer count intact.

With chatbots and virtual AI assistants, fintech organizations can easily request data verification before initiating payment requests and transfers. And Machine Learning capabilities encrypt the conversation and control the exchange of data between platforms and users.

This way privacy and users’ personal information are protected within the platform. And if any discrepancy and fraud occur, the bot can immediately alert the customer and employee for better assistance and data protection.

Conclusion

As per Accenture, financial institutions that are investing in AI and human-bot collaboration will grow their revenue by 34% in 2022. So, isn’t it the right time to invest in conversational AI and build the financial workforce of the future?

Moreover, NLP and machine learning are continually evolving, and it would be challenging to assure whether you are interacting with a person or a bot. Hence, with conversational AI in your business space, you can automate customer data, and enhance customer experience with increased human-bot interaction.

With an impressive track record, AutomationEdge has been helping financial institutions and BFSI players to adopt conversational AI to go hyper-digital in consumer experience and prevent events that may cause huge losses to their business.

In the automation-anxiety era, AutomationEdge is happy to enhance your digital infrastructure to rise stronger in the fintech domain. So if you want to know more about AutomationEdge’s Conversational RPA, request a demo here.